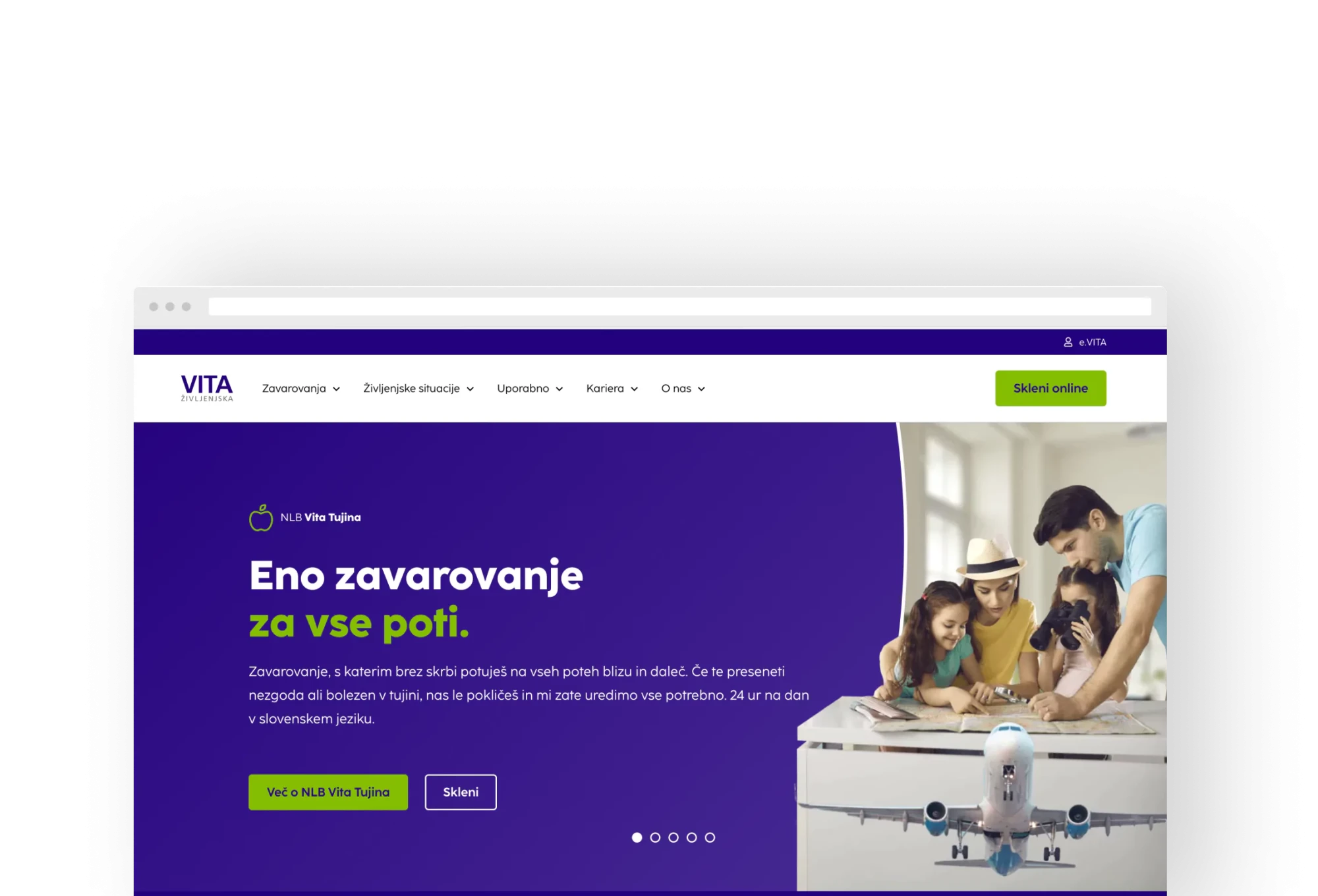

Client

Vita, a life insurance company, is the largest bank-affiliated insurer in the Slovenian market. With a focus on above-average growth and business optimization, digital transformation is a key aspect of the company's development. In this light, the company decided to undergo a complete overhaul of its online presence with the following goals:

- Attract new customers,

- Improve the user experience,

- Enable customers to independently (online) purchase insurance where possible,

- Enhance the capacity of the advisory process,

- Optimize the sales process.

This approach addresses customer demands for better transparency of offerings and the ability to complete as many insurance services online as possible. A high-quality user experience is simply good for business.

Concept

Together with the client, we defined clear project objectives:

- Simplify the process of selecting and purchasing insurance products,

- Design the experience primarily from the user's perspective,

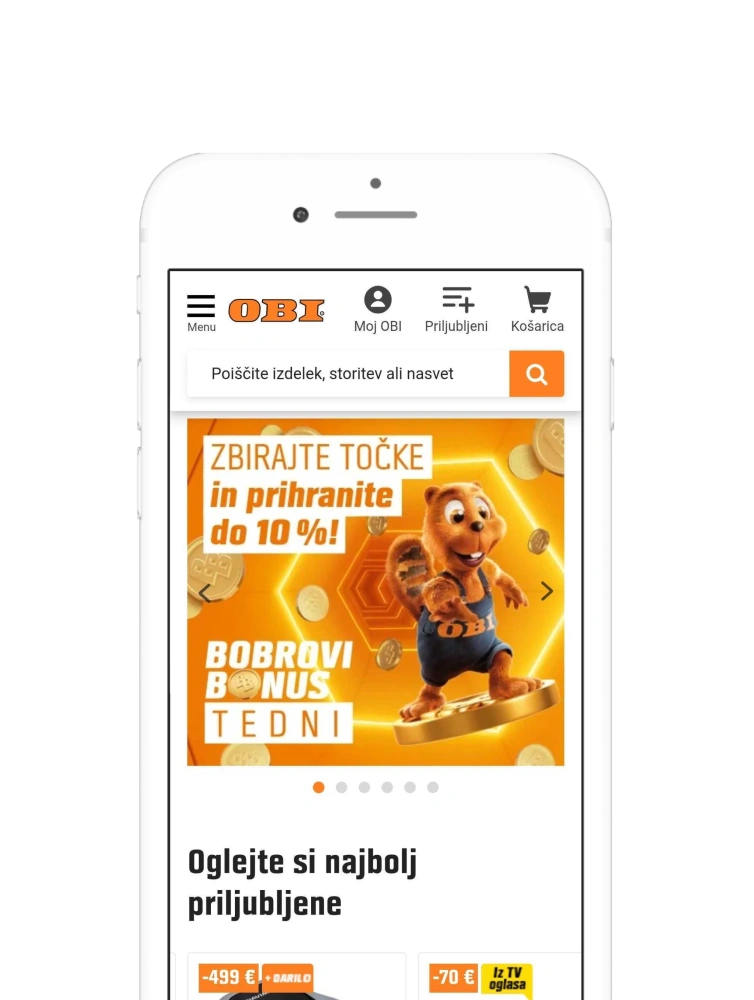

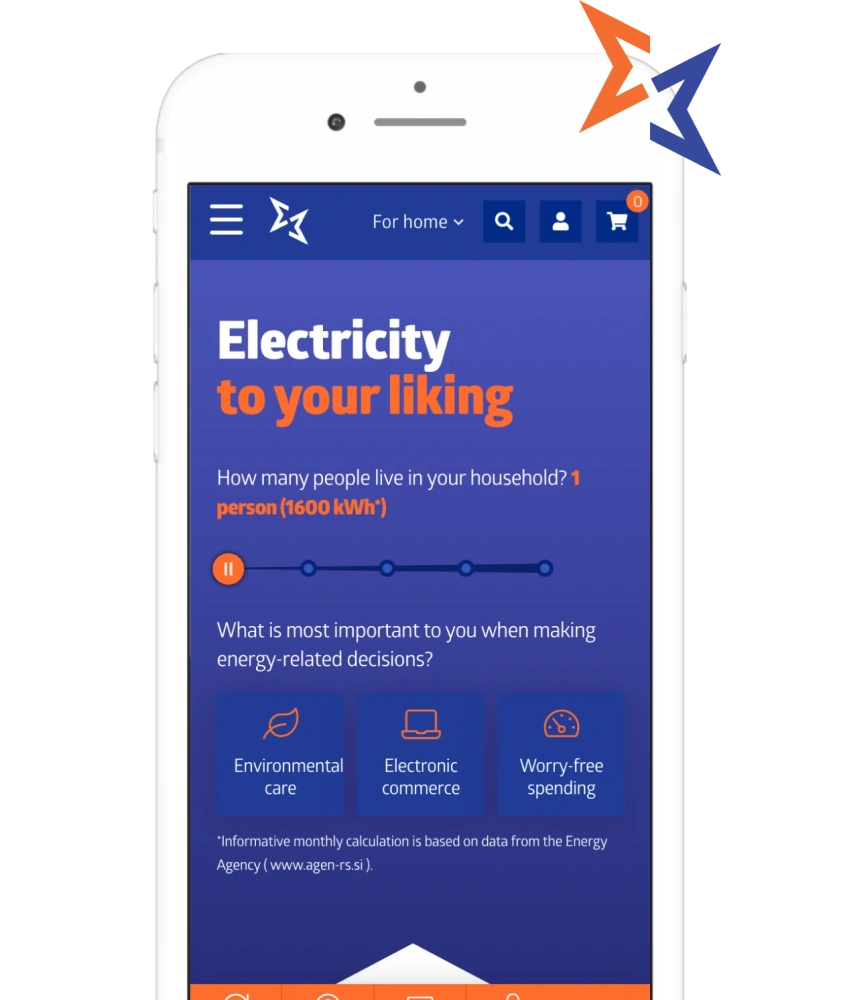

- Focus on mobile experience,

- Tailor user scenarios to each insurance product,

- Direct all paths toward the sales process.

The project comprised redesigning the website, establishing a digital branch, and developing a hybrid mobile application.

Solution

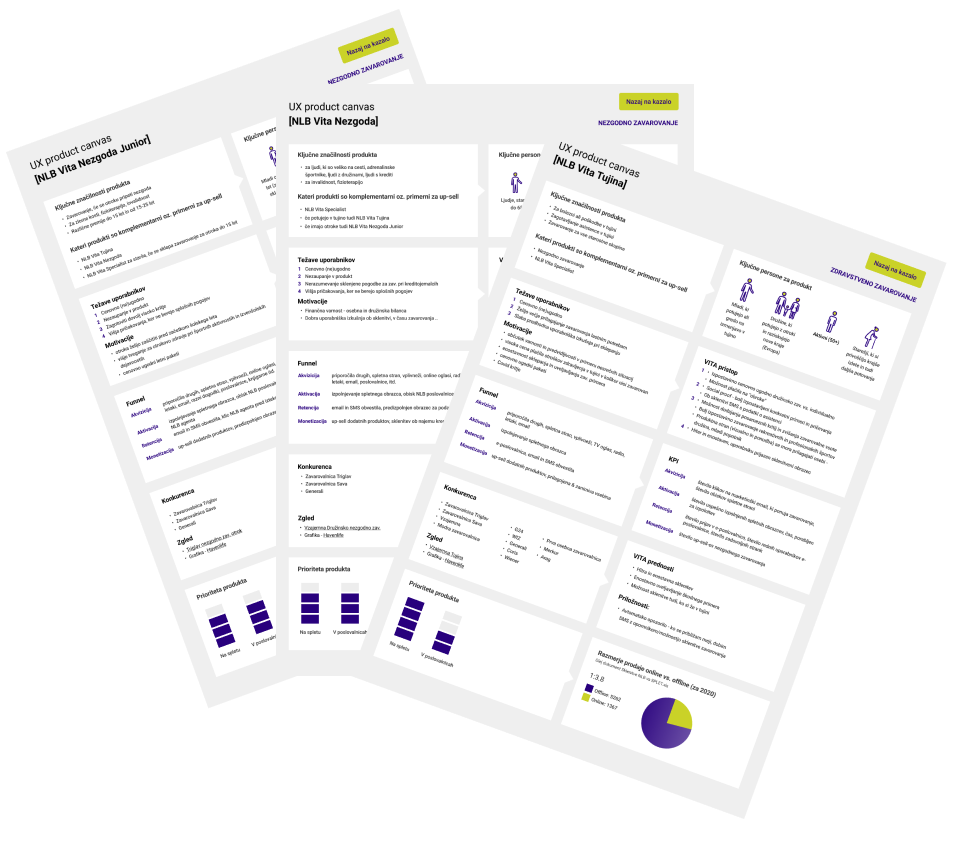

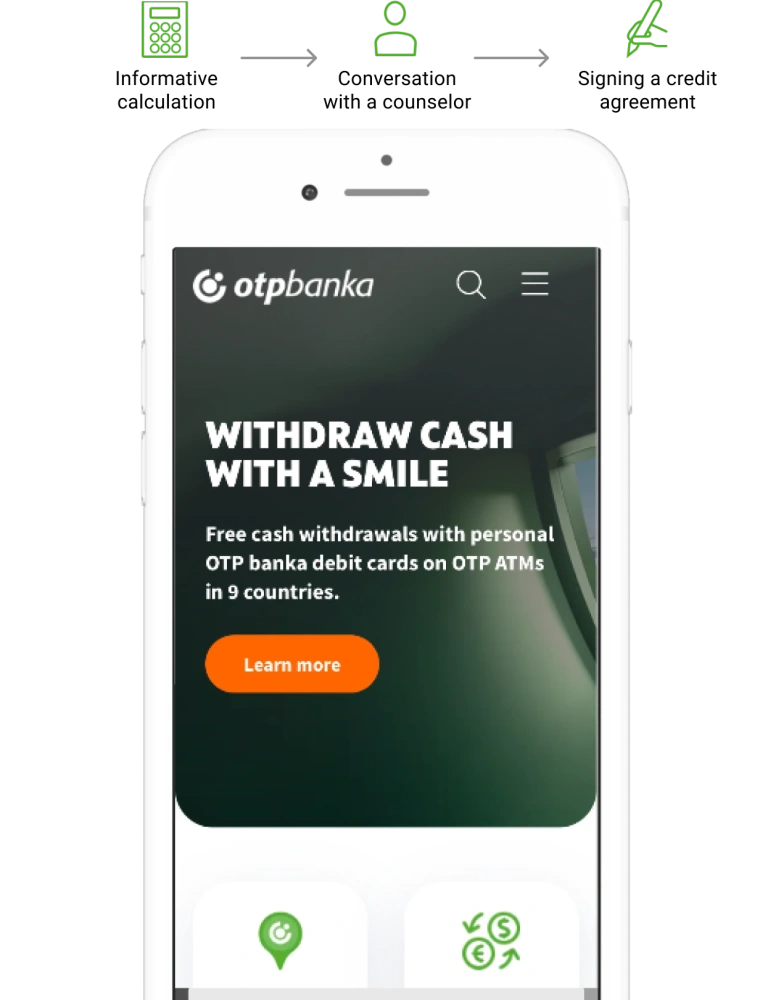

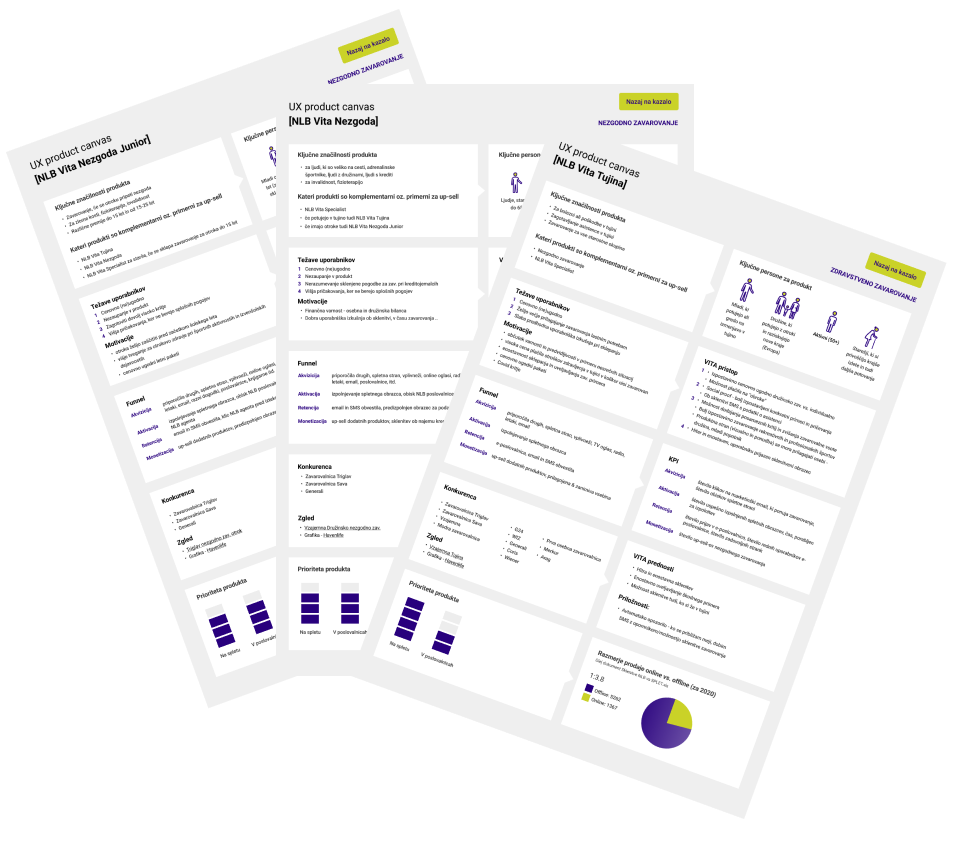

Creatim's UX team categorized insurance products based on the extent to which the purchasing process can be completed online.

Some insurance products, such as accident insurance for adults and children, health assistance abroad, and health insurance for faster access to specialists, can be purchased entirely online. For other products, legal restrictions require customers to visit a branch to finalize the purchasing process or involve disproportionate effort on the user's part to meet legal requirements remotely.

Nonetheless, digital experiences are now integral to all insurance products and a core component of every insurance company's business strategy.

User Experience

The design of the user experience took place over several cycles. In each cycle, we considered feedback from various stakeholders (domain experts, end-users). Within this intersection, we sought solutions that provide a high-quality experience while encouraging conversions and sales growth.

However, even the most meticulous planning cannot provide all the answers; therefore, we decided to test every proposed solution thoroughly.

For each product, we defined typical personas and tailored the sales funnel to meet their needs. Individual usage scenarios were tested with real users on mobile and desktop devices. Test participants were tasked with finding suitable insurance and completing the purchase online, all while providing verbal feedback on their experience.

This process gave us valuable insights into user behavior, from initial information gathering to the final purchasing decision. These insights guided us in designing user scenarios and identifying potential friction points that could negatively impact the purchasing process.

These findings were incorporated into the conceptual design process. The emphasis was on managing complexity and creating as simple experiences and understandable as possible for users, especially on mobile devices.

Technical Development

The technical aspect of the project encompassed three components: the website, the e.VITA mobile application, and a universal multi-stage purchasing form. Due to the handling of sensitive personal data, several security protocols were integrated into the solution, and users' personal data is stored exclusively in the client's databases. Independent security experts conducted multiple penetration tests to confirm the app’s security compliance.

Multi-stage purchasing form

A significant challenge was the multi-stage purchasing form, which dynamically adapts to the selection of products at each stage of the form-filling process, allowing users to purchase multiple insurance policies consecutively, with various options, and build their insurance portfolio.

The form is integrated into both the website and the digital branch, optimized for desktop and mobile environments. It was designed using hybrid technology, enabling it to function as a native-like mobile app on smartphones. All user interfaces are powered by a unified source code. This architecture helped manage complexity, optimize development, and ensure more affordable solution maintenance.

The solution was built using Vue3 JavaScript technology, which is more powerful than previous versions and allows for easier code maintenance. This version also includes improved support for TypeScript and reactivity at a more granular level. Due to this high adaptability, Vue3 is an excellent choice for creating dynamic web applications, such as the purchasing form in this project.

Results

Following the launch of the revamped website, organic traffic increased by 25% compared to the same period in the previous year. An additional boost in traffic was driven by a promotional advertising campaign. We also exceeded the engagement rate target (>70%).

The most gratifying result is the high conversion rate. A great example is travel insurance, where a whopping 20% of users who initiate the purchasing process complete it. Such results demonstrate that our work achieved its purpose.

Are you also struggling with low website conversion rates? Contact us, and together we’ll find a solution.